Many employees receive fringe benefits—employers pay for payroll taxes, pension costs, and paid vacations. These fringe benefit costs can significantly increase the direct labor hourly wage rate. Other companies include fringe benefit costs in overhead if they can be traced to the product only with great difficulty and effort. Manufacturing cost is the core cost categorization for a manufacturing entity. It encompasses the costs that must be incurred so as to produce marketable inventory.

Part of cost of goods sold

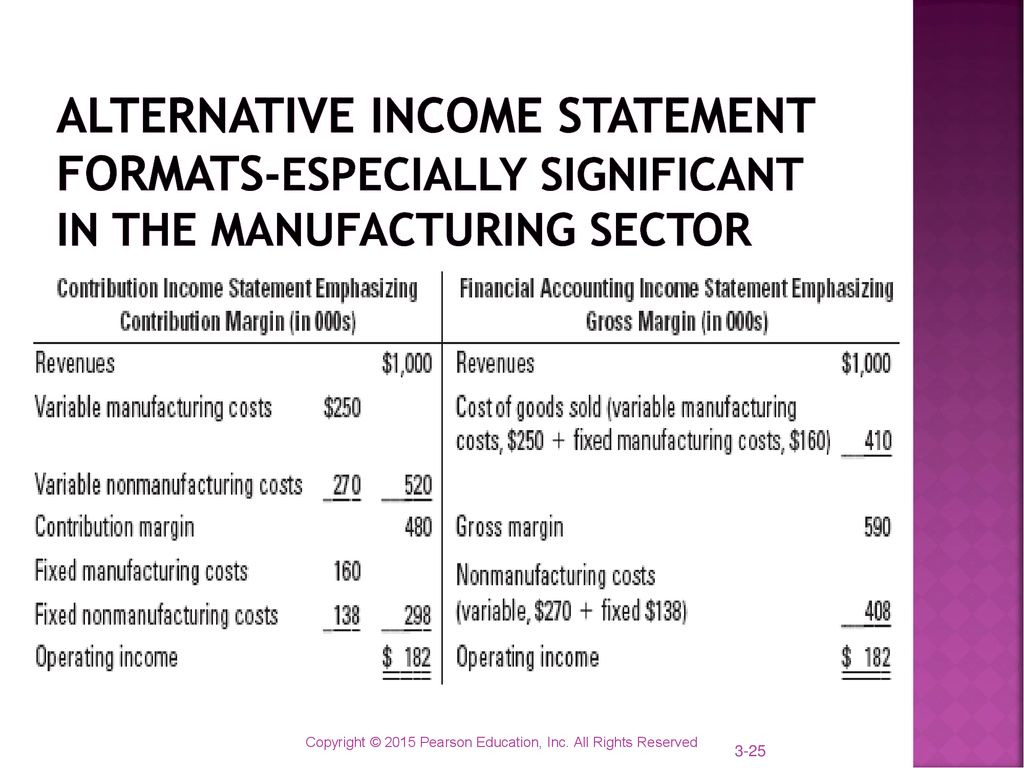

For this reason, firms expense (deduct from revenues) period costs in the period in which they are incurred. Accountants treat all selling and administrative expenses as period costs for external financial reporting. Direct materials should be distinguished from indirect materials (part of overhead costs), about which we will talk later. The products in a manufacturer’s inventory that are completed and are awaiting to be sold. You might view this account as containing the cost of the products in the finished goods warehouse. A manufacturer must disclose in its financial statements the amount of finished goods, work-in-process, and raw materials.

- Knowing the overhead cost per unit is helpful in understanding what the manufacturing overhead costs will be if the company plans to double their production (in other words, make 40,000 smartphones) in the future, for instance.

- To calculate the cost of direct materials you need to know the cost of inventory.

- Manufacturing costs are also known as factory costs or production costs.

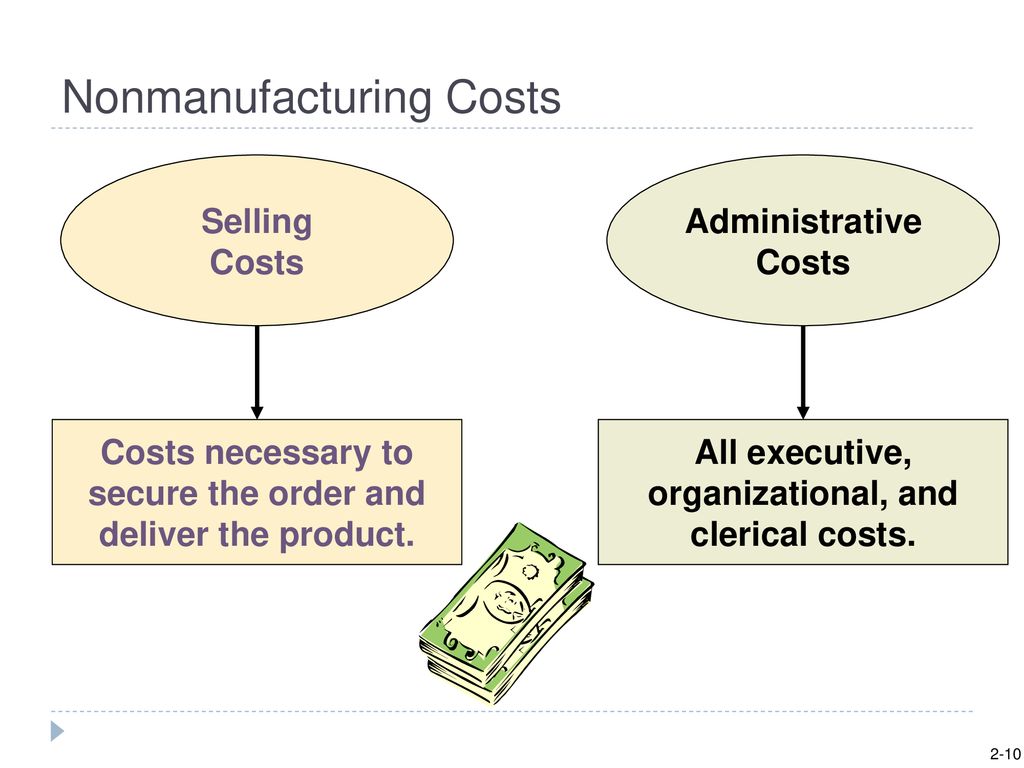

- These costs encompass a variety of expenses such as selling, administrative, and research and development costs, which support the overall operations of a business but do not contribute to the creation of products.

- Direct labor manufacturing costs is determined by calculating the cost of employees directly responsible for producing the product.

Nonmanufacturing overhead costs definition

These costs have two components—selling costs and general and administrative costs—which are described next. Firms account for some labor costs (for example, wages of materials handlers, custodial workers, and supervisors) as indirect labor because the expense of tracing these costs to products would be too great. Indirect labor consists of the cost of labor that cannot, or will not for practical reasons, economic order quantity eoq be traced to the products being manufactured. As their names indicate, direct material and direct labor costs are directly traceable to the products being manufactured. Manufacturing overhead, however, consists of indirect factory-related costs and as such must be divided up and allocated to each unit produced. For example, the property tax on a factory building is part of manufacturing overhead.

Direct Material Manufacturing Costs

Kavitha Simha is a productivity author and researcher, passionate about finding smarter ways to manage time. Combining her knowledge of multiple disciplines, she seeks to help others optimize their work-life balance, which she believes is the key to minimizing stress. Optimize your workforce, take control of inefficiencies, and watch your profits soar with team time tracking software. Effectively managing expenses in manufacturing isn’t just an option — it’s a necessity. For example, you can allocate depreciation costs of refrigerators to the department that uses them.

Some Examples of Non-manufacturing Costs

For that purpose, the company used sensors to collect and analyze the cost of materials in real time to see how to optimize the costs. Knowing the overhead cost per unit is helpful in understanding what the manufacturing overhead costs will be if the company plans to double their production (in other words, make 40,000 smartphones) in the future, for instance. Be sure to allocate overhead costs to the respective cost centers (specific departments, processes, or machines in the manufacturing facility that contribute to the manufacturing costs).

As with direct material costs, direct labor costs of a product include only those labor costs clearly traceable to, or readily identifiable with, the finished product. The wages paid to a construction worker, a pizza delivery driver, and an assembler in an electronics company are examples of direct labor. Note that all of the items in the list above pertain to the manufacturing function of the business. Rather, nonmanufacturing expenses are reported separately (as SG&A and interest expense) on the income statement for the accounting period in which they are incurred. The wood used to build tables and the hardware used to attach table legs would be considered direct materials.

With a breakup of all the costs of manufacturing, management can decide whether it is more profitable to purchase certain parts or materials from a vendor or manufacture them in-house. As you can see, by collecting cost data and calculating it accurately, businesses can optimize cost management and set the right price for their products to gain a competitive advantage. Here’s an interesting case study on how manufacturing cost analysis helped a steel manufacturing company save costs.

Direct labor would include the workers who use the wood, hardware, glue, lacquer, and other materials to build tables. In fact, you already know that labor costs can spiral out of control if you don’t meticulously monitor them. Manufacturers can compare the costs of making a product using different manufacturing processes.

In addition to indirect materials and indirect labor, manufacturing overhead includes depreciation and maintenance on machines and factory utility costs. Look at the following for more examples of manufacturing overhead costs. Distinguishing between the two categories is critical because the category determines where a cost will appear in the financial statements.

Non-manufacturing costs include those costs that are not incurred in the production process but are incurred for other business activities of the entity. These costs do not specifically contribute to the actual production of goods but are essential to ensure overall functioning of the business. For a manufacturer these are expenses outside of the manufacturing function. Instead these expenses are reported on the income statement of the period in which they occur. By calculating manufacturing costs, companies can clearly understand the true cost of making a product.